Guest post written by Dr. Jason Landry

Jason is a phenomenal Emergency Medicine Doctor who resides in Jacksonville, FL. Even more astounding, however, is his incredible knowledge regarding the ever-changing stock market and overall financial success! With the wavering situation we are finding ourselves in economically, I asked Jason to give his insight and wisdom on how to handle it, and what to do! I'm sure you'll enjoy his hands-on strategies as much as I have!

Let me start by saying that I do not have a degree in

Business, nor am I employed by any Trust Funds, Banks, or even the little

talking baby you see on TV who has become a day-trader. I am just like everybody else who wants

to know that if I put money away for retirement, it will be ready for me to use

one day. For decades, the most

accepted way to do this was by systematically putting money into a Roth, 401k,

or other equivalent plan and just watching it grow like magic.

However, over the last few years, it has become increasingly

difficult to justify putting money into the market, only to see your account

shrink and shrivel. Sometimes it

can even make me a bit angry and frustrated. I feel like I could do better by just burying the money in

my backyard or just setting up a simple savings account. That way, I know that, at least, my

money is growing a little. Every

time I start thinking this way, however, I am reminded of some very simple

principles. Maybe they will help

you find the courage to deposit that next check into the retirement fund, even

when the market seems to just fizzle it away.

1.

DOLLAR-COST AVERAGING: This is the most

important principle. It means that

you put a fixed amount of money into your account at fixed time intervals,

regardless of how the market is doing.

In the end you will make money, even if the market ends up at the exact

same point as where it started.

For example, let’s assume you

put in $100 every month for 30 years (360 months). If you buried that in your backyard, it

would be worth $36000 when you dug it up 30 years later. If you put it in a savings account

(right now with an interest rate of 0.1%), it would be worth a bit better at $36,647.19. However, let’s assume that you put it

in the market. And, just to make

the math easy, let’s assume 1 share is worth $100. Over the 30 years, it stays at $100/share 50% of the time

(including the ending price). But,

it also is valued at $50/share 25% of the time and $150/share 25% of the

time. In 30 years, if you were

diligent, you would own 420 shares, or $42,000. That’s 14.6% better than you would have done by putting the

money in a savings account!

2.

THE POWER OF TIME: If you look back at the last

few years, the market looks pitiful.

All it does is go down! But

if you graph out the value of the Dow, for example, over the last 20-30 years,

a much different (and more promising) trend strikes you. Just in the 1970’s, the Dow was valued

around 1000. Now it’s around

11000! Over time, the markets grow

and people make money….if they can stomach the “Down Years”.

3.

Inflation: One big problem with burying your

money out in the yard, or even placing it in a savings account, is that the

dollar becomes increasingly less valuable over time. This is called “Inflation”. If you ask your grandma, I’m sure she will talk your ear off

about how she used to be able to buy a hamburger for a nickel, for

example. Good luck finding that

burger now! If you bury $100

outside, it’s not going to be worth nearly $100 in 30 years. You need to find a way to make it grow

faster than the rate of inflation.

Time and time again, the only method that has proven to beat inflation

is the market. If you like

hamburgers as much as me (just ask my wife), you’ve got to find a way to save

up so you can afford them in 30 years.

Again, I’m not a financial

planner, nor did I stay at a Holiday Inn Express last night. I just want to be a good steward of the

money God blesses me with. I know

this stuff is not simple in the least.

That’s why you really ought to get in touch with a Certified Financial

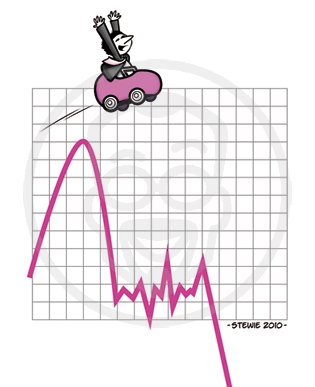

Planner who can figure out what is the wisest plan for you specifically. Speaking from personal experience, they

also make really good therapists when you start stressing out about this crazy

Stock Market Roller Coaster.

Find more information about Dr. Jason Landry by clicking HERE.

No comments:

Post a Comment